wealthfront vs betterment tax loss harvesting

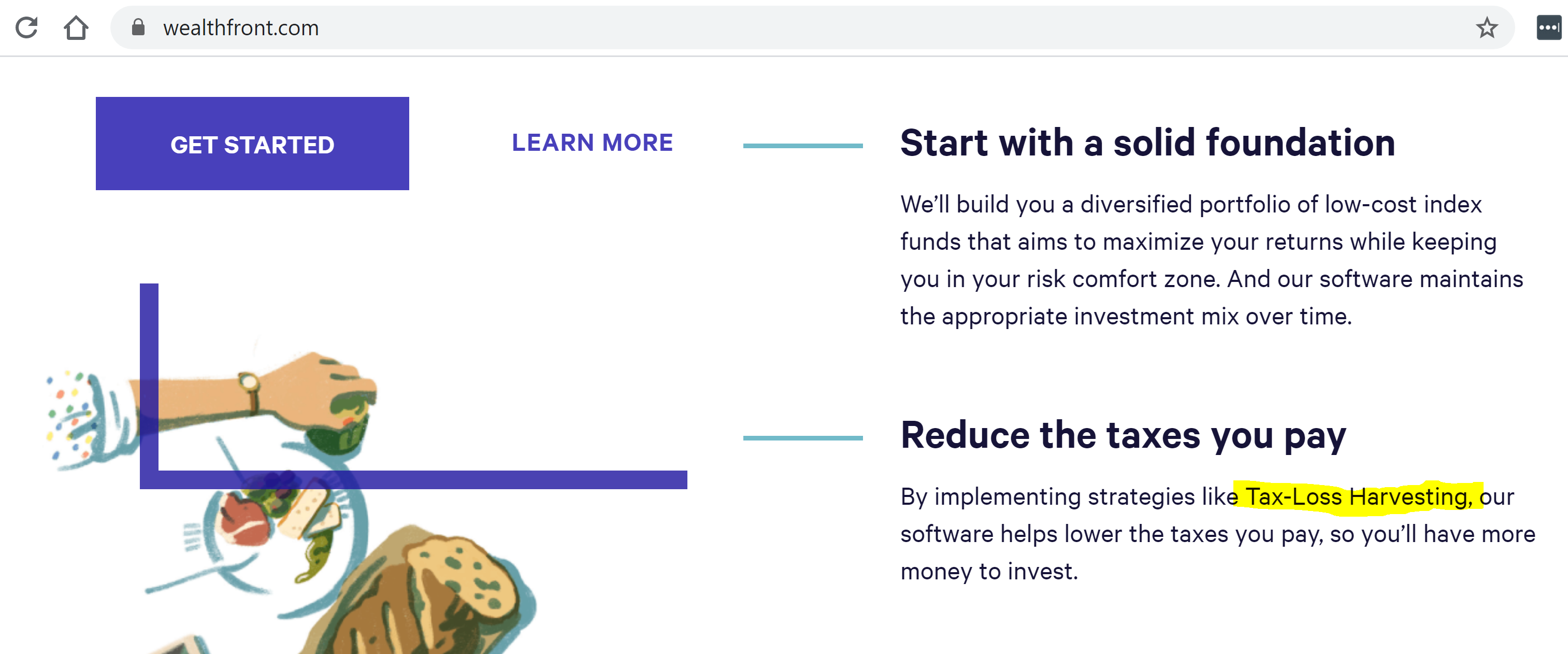

Tax loss harvesting is an advanced investment strategy that Wealthfront and Betterment have both brought to consumers at no. Wealthfront and Betterment both offer tax loss harvesting at no extra cost.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment and Wealthfront are neck and neck when it comes to management fees which go to the robo-advisor and fund fees which go to the fund company that created.

. Wealthfront vs Betterment. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Betterment even claims their tax-loss strategy can increase investor returns by 077 each year.

Wealthfront Fees and Plans Betterment. Contact a Fidelity Advisor. Ad Automated And Sophisticated Investment Strategies To Optimize Performance At A Low Cost.

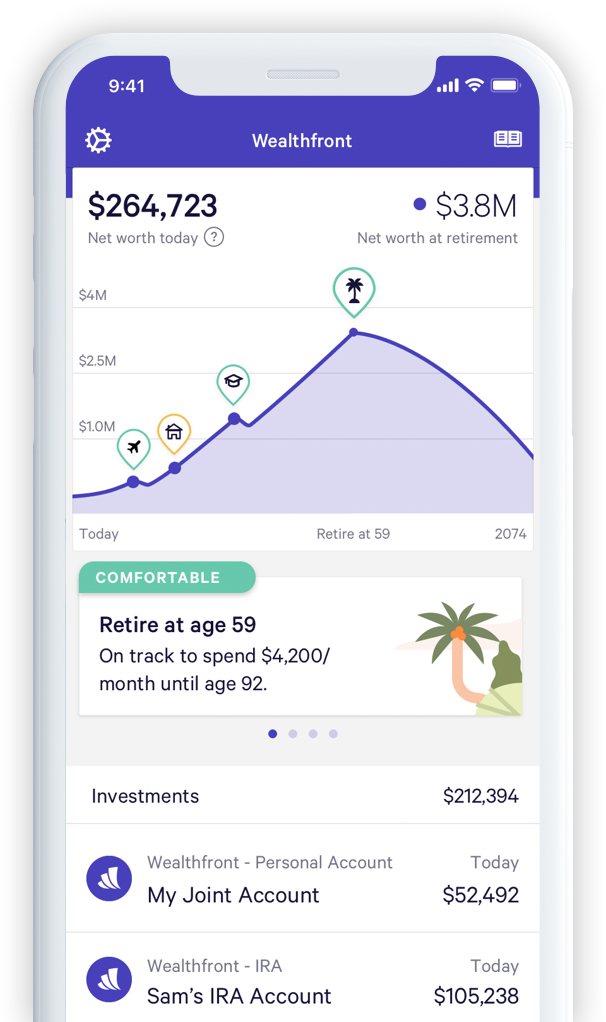

Heres a short video about it. Wealthfront is best for those seeking to customize their investments-including cryptocurrency-with hundreds of additional ETFs and daily tax-loss harvesting. You can open an account with no money at all.

Contact a Fidelity Advisor. Betterment and Wealthfront both charge an annual fee of 025 for digital portfolio management. Harvested losses can be applied to offset both capital gains and up to.

Betterment and Wealthfront both make investing easy by offering useful features like daily tax-loss harvesting and wealth-building tools. Wealthfront offers across-the-board pricing at 025 regardless of portfolio size or plan. All three robo-advisors offer tax-loss harvesting in some form.

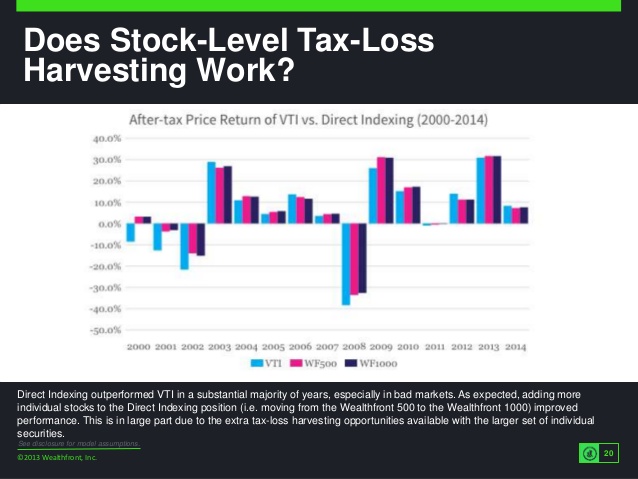

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. 1 day agoBetterment vs. Unlike Betterment Wealthfront uses stock-level tax-loss harvesting to invest directly in the SP 500 and not just ETFs.

Wealthfront and Betterment automatically does tax loss harvesting for you. Ad Automated And Sophisticated Investment Strategies To Optimize Performance At A Low Cost. Human assisted investment advice.

They both offer tax loss harvesting. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Grow Your Long-Term Wealth Effortlessly At A Low Cost.

This is free for all. Their methods for tax harvesting. Betterment offers the following tax strategies.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Betterment and Wealthfront pros Betterment. Betterment offers the following tax strategies.

Wealthfront also offers tax-loss harvesting via direct indexing and automated portfolio rebalancing. Both Betterment and Wealthfront enable tax-advantaged investing through tax-loss harvesting. Grow Your Long-Term Wealth Effortlessly At A Low Cost.

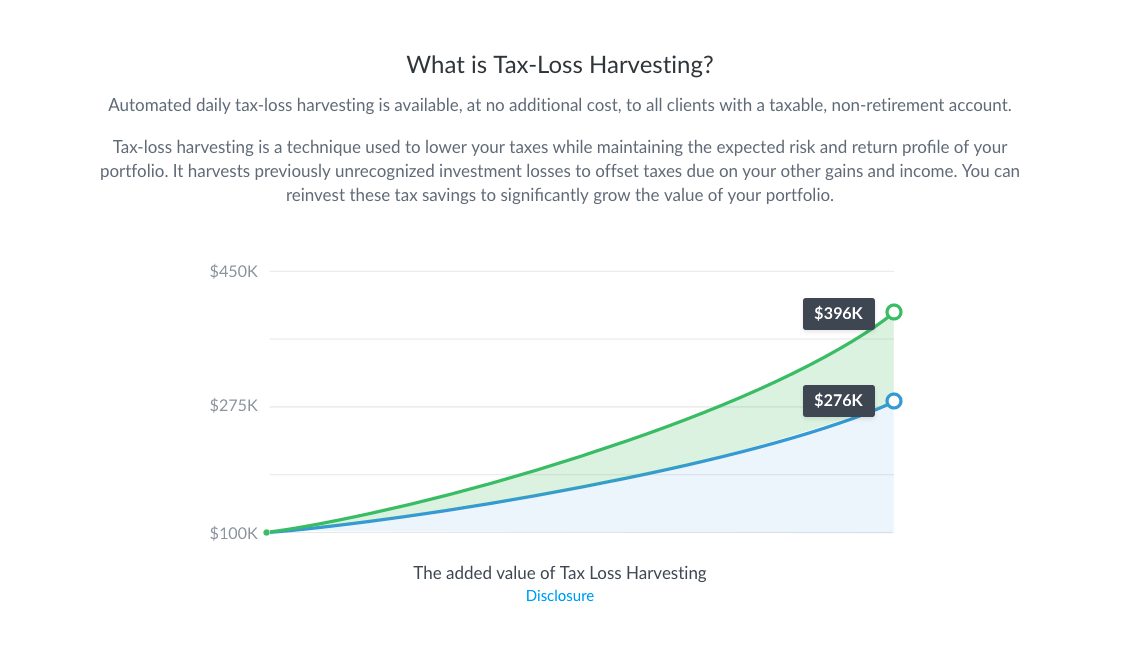

Essentially a tax-efficient Robo-advisor will increase. Actually Tax-Loss Harvesting is especially valuable for investors who regularly recognize short-term capital gains. Tax-Loss Harvesting is a strategy that takes advantage of movements in the markets to capture investment losses which can reduce your tax bill leaving.

TurboTax customers can easily import tax-loss harvesting data from. This process minimizes taxes by selling. Tax efficiency is a big factor to consider when choosing a Robo-advisor.

Tax-loss harvesting on all taxable accounts. If I look at the value prop for Betterment or Wealthfront it seems that I can achieve all of the benefits of their service through Vanguard using Admiral Total Market funds except for tax. Best of all if you sell more losses than gains you can carry those forward to the following tax year.

You like a simple fee structure. Wealthfront avails tax loss Harvesting using your losses to offset taxes that would be levied on your gains to everyone using their platform providing benefits to all users alike. Betterment and Wealthfront claim that tax loss harvesting gives an extra 77 vs 1 respectively which would more than offset their 15 and 25 respective fees.

Wealthfront does have a distinct advantage over Betterment because it. Key differences include the option to. Both Wealthfront and Betterment offer tax-loss harvesting for their taxable accounts while making sure to avoid wash sales.

Betterment vs Wealthfront Tax-loss Harvesting. If you have the cash Wealthfront has a definite. This is unlike Betterment which has a 040 fee on.

Wealthfront Review How Good Is This Popular Robo Advisor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wealthfront Vs Betterment Wealthfront

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment And Wealthfront Are The Robos To Watch In The Battle Against Incumbents See How Their Strategies Stack Up Now And Robo Advisors Good Things Advisor

Tax Loss Harvesting Is Overrated Frugal Professor

Sigfig Vs Wealthfront Which Robo Advisor Is Best For You

The 5 Best Robo Advisors For Tax Loss Harvesting Moneymade

Betterment Vs Wealthfront Which Robo Advisor Is Right For You

/wealthfront-vs-charles-schwab-intelligent-portfolios-dc8b708347dc461fb7dd0970a48de0c3.jpg)

Wealthfront Vs Charles Schwab Intelligent Portfolios

Wealthfront Vs Unifimoney Choosing A Better Robo Advisor Unifimoney

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

Get Everything Investment Management Including Advice Automated College Planning Financial Advice More From Investing Personal Finance Budgeting Money

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Which Is Better For Investing Betterment Vs Wealthfront Gobankingrates